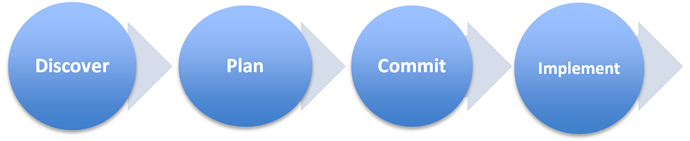

Our Process

Broadhurst Financial Advisors comprehensive process pulls your financial plan together. Working alongside you, we provide total wealth management to simplify your finances. Our process eliminates the problems that can occur when you must manage multiple advisors. We don't promise quick answers or easy solutions. Instead, we offer a prudent process with a long-term focus that allows you to meet life's most important goals. Our process includes:

Phase 1

Understanding where You Are Now... ...and where You Want to Go

How do we understand your needs, concerns, hopes and dreams?

- Discover: In our first meeting, we explore your true financial needs, goals, concerns, and evaluate your current financial position. We begin to understand you and your situtation.

- Plan: With a thorough understanding of your current assets and liabilities, we meet to suggest a customized asset allocation for you and explain how it will improve your portfolio and better achieve your goals.

- Commit: Once you have had a chance to review your improved portfolio for a week, we meet again to answer all of your questions, respond to any concerns, and then mutually commit on to implementation.

- Implement: We move your investment strategy forward, consolidate positions, transfer your assets to the custodian, simplify your statements and ensure you have online access 24/7.

With our process, we take the time to understand what matters to you, and then design solutions around your preferances and goals.

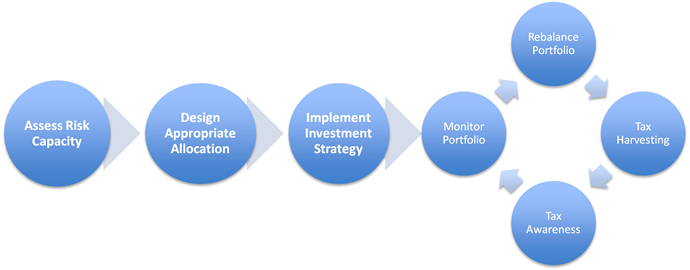

Phase 2

Putting Your investment Plan into Action

How do we develop and implement an investment plan that is "right" for you?

- Assess Your Risk Capacity: Using our discussions in the Discovery meeting and your risk evaluations, we measure your unique risk tolerance. We determine your ability and willingness for risk.

- Design Appropriate Allocation: By using state-of-the-art portfolio modeling software, we create investment portfolios that balance long-term performance with minimized risk. We identify a portfolio that matches your capacity for risk with your comfort for risk and your financial plan.

- Implement Your Investment Strategy: With the investment policy understood, we choose the appropriate investments to achieve your goals. We construct a risk-appropriate, globally diversified, tax-efficient portfolio of low cost DFA funds.

- Locate Assets: We consider the tax implications of asset location. Different assets have different tax characteristics. We put the tax efficient into your taxable accounts and tax inefficient assets into your IRA accounts.

- Monitor Your Portfolio: Even with the "right" asset allocation strategy it is critical to track and evaluate your portfolio's performance against a risk-appropriate, diversified benchmark, as well as common, industry standard benchmarks.

- Rebalance Asset Winners: Periodically we realign your investments when out of balance by certain tolerance levels. We may sell winning assets to keep your asset allocation in balance in your IRA accounts, while avoiding realizing gains in your taxable accounts. We will meet with you quarterly to review progress and explain necessary portfolio changes.

- Harvest Tax Losers: We may opportunistically sell positions that have gone down below their original cost, and thus "realize" a loss so that you pay less tax, or offset future gains with no tax bill.

With our process, your investment strategy goes hand-in-hand with your tax strategy, which can add significantly to your after-tax return.

Phase 3

Consultative Wealth Management Solutions

After we've agreed upon and established your investment plan, we begin to discuss and implement your wealth management plan. We draw a detailed road map to help you get where you achieve all that is most important to you. This part of the process includes ongoing consultation:

After we've agreed upon and established your investment plan, we begin to discuss and implement your wealth management plan. We draw a detailed road map to help you get where you achieve all that is most important to you. This part of the process includes ongoing consultation:

- Expert Team Meeting: We discuss your situation with our team of experts and begin to identify unique solutions for you, including risk management, estate planning, tax strategy, and legacy planning.

- Advance Planning Discussion: We meet with you to discuss the recommendations from our team of experts and prioritize the action plan with you.

- Review and Monitor: We regularly evaluate your investment portfolio and other solutions to ensure they are sound and appropriate.

- Regular Progress Meetings: We will regularly meet with you to review your progress to make sure your financial plan remains in line with your goals.

- Adjust Your Plan: As life changes, so do your goals and situation. We suggest appropriate changes in strategy for your stage of life.

With our process, the unique wealth management solutions we provide can significantly add value, save you money, lower stress, reduce taxes and avoid expensive mistakes. We help you make smart financial decisions.